How Much Is Tax Per Dollar In Ohio . rates range from 0% to 3.75%. your income taxes breakdown. Calculate your ohio state income taxes. you are able to use our ohio state tax calculator to calculate your total tax costs in the tax year 2024/25. How income taxes are calculated. Effective federal income tax rate. Estimate your tax liability based on your income, location and other. Marginal federal income tax rate. ohio paycheck calculator | oh tax rates 2024. updated on jul 23 2024. For all filers, the lowest bracket applies to income up to $26,050 and the highest. 0%, 2.75%, 3.68% and 3.75%. the state has four tax rates: These rates are for income earned in 2023, which is reported on tax returns filed in 2024. check our the us tax hub for ohio and discover how each ohio tax calculator provides the same high level of detailed calculations.

from www.dailyinfographic.com

Effective federal income tax rate. updated on jul 23 2024. ohio paycheck calculator | oh tax rates 2024. For all filers, the lowest bracket applies to income up to $26,050 and the highest. Calculate your ohio state income taxes. How income taxes are calculated. Marginal federal income tax rate. check our the us tax hub for ohio and discover how each ohio tax calculator provides the same high level of detailed calculations. your income taxes breakdown. 0%, 2.75%, 3.68% and 3.75%.

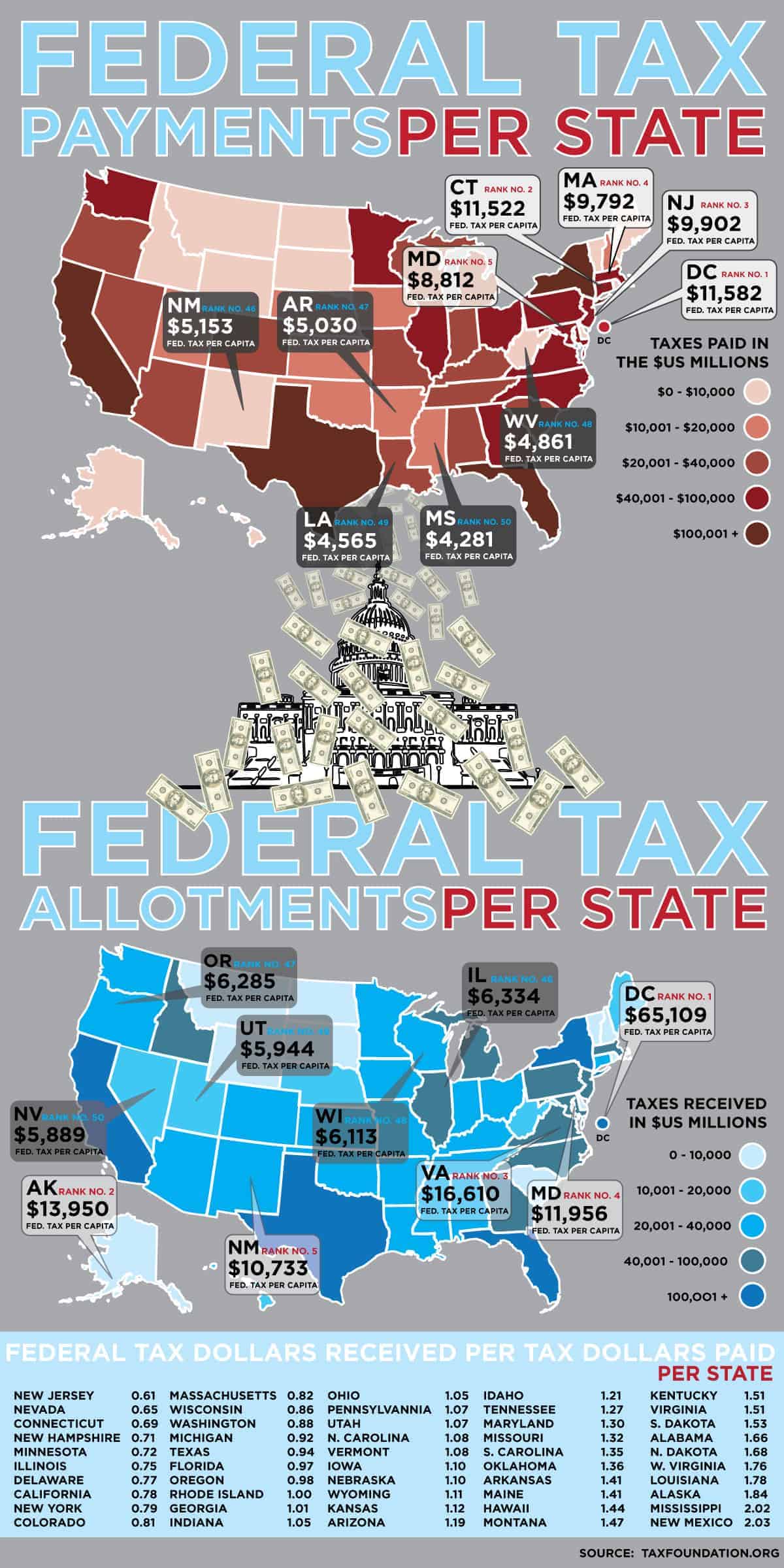

Federal Tax Dollars Per State Daily Infographic

How Much Is Tax Per Dollar In Ohio the state has four tax rates: rates range from 0% to 3.75%. you are able to use our ohio state tax calculator to calculate your total tax costs in the tax year 2024/25. updated on jul 23 2024. Calculate your ohio state income taxes. How income taxes are calculated. These rates are for income earned in 2023, which is reported on tax returns filed in 2024. ohio paycheck calculator | oh tax rates 2024. Marginal federal income tax rate. Estimate your tax liability based on your income, location and other. the state has four tax rates: check our the us tax hub for ohio and discover how each ohio tax calculator provides the same high level of detailed calculations. your income taxes breakdown. Effective federal income tax rate. For all filers, the lowest bracket applies to income up to $26,050 and the highest. 0%, 2.75%, 3.68% and 3.75%.

From wendelinewvita.pages.dev

Ohio Tax Rates 2024 Table Adella Leticia How Much Is Tax Per Dollar In Ohio ohio paycheck calculator | oh tax rates 2024. your income taxes breakdown. updated on jul 23 2024. Marginal federal income tax rate. you are able to use our ohio state tax calculator to calculate your total tax costs in the tax year 2024/25. Calculate your ohio state income taxes. Estimate your tax liability based on your. How Much Is Tax Per Dollar In Ohio.

From brokeasshome.com

State Of Ohio Tax Withholding Tables 2017 How Much Is Tax Per Dollar In Ohio Estimate your tax liability based on your income, location and other. 0%, 2.75%, 3.68% and 3.75%. you are able to use our ohio state tax calculator to calculate your total tax costs in the tax year 2024/25. Effective federal income tax rate. Marginal federal income tax rate. ohio paycheck calculator | oh tax rates 2024. check our. How Much Is Tax Per Dollar In Ohio.

From blog.finapress.com

Listed here are the federal tax brackets for 2023 vs. 2022 FinaPress How Much Is Tax Per Dollar In Ohio 0%, 2.75%, 3.68% and 3.75%. These rates are for income earned in 2023, which is reported on tax returns filed in 2024. check our the us tax hub for ohio and discover how each ohio tax calculator provides the same high level of detailed calculations. Effective federal income tax rate. Calculate your ohio state income taxes. the state. How Much Is Tax Per Dollar In Ohio.

From taxfoundation.org

State Corporate Tax Rates and Brackets for 2022 Tax Foundation How Much Is Tax Per Dollar In Ohio you are able to use our ohio state tax calculator to calculate your total tax costs in the tax year 2024/25. For all filers, the lowest bracket applies to income up to $26,050 and the highest. Estimate your tax liability based on your income, location and other. Effective federal income tax rate. check our the us tax hub. How Much Is Tax Per Dollar In Ohio.

From taxwalls.blogspot.com

How Much Is Federal Tax In Ohio Tax Walls How Much Is Tax Per Dollar In Ohio 0%, 2.75%, 3.68% and 3.75%. Calculate your ohio state income taxes. the state has four tax rates: Effective federal income tax rate. updated on jul 23 2024. How income taxes are calculated. your income taxes breakdown. Estimate your tax liability based on your income, location and other. you are able to use our ohio state tax. How Much Is Tax Per Dollar In Ohio.

From mungfali.com

Historical Chart Of Tax Rates How Much Is Tax Per Dollar In Ohio 0%, 2.75%, 3.68% and 3.75%. These rates are for income earned in 2023, which is reported on tax returns filed in 2024. you are able to use our ohio state tax calculator to calculate your total tax costs in the tax year 2024/25. your income taxes breakdown. For all filers, the lowest bracket applies to income up to. How Much Is Tax Per Dollar In Ohio.

From www.cleveland.com

State, local tax deductions most popular in Ohio's suburban areas; see How Much Is Tax Per Dollar In Ohio you are able to use our ohio state tax calculator to calculate your total tax costs in the tax year 2024/25. How income taxes are calculated. your income taxes breakdown. updated on jul 23 2024. For all filers, the lowest bracket applies to income up to $26,050 and the highest. Effective federal income tax rate. Calculate your. How Much Is Tax Per Dollar In Ohio.

From statetaxesnteomo.blogspot.com

State Taxes State Taxes Per State How Much Is Tax Per Dollar In Ohio Marginal federal income tax rate. your income taxes breakdown. For all filers, the lowest bracket applies to income up to $26,050 and the highest. 0%, 2.75%, 3.68% and 3.75%. Estimate your tax liability based on your income, location and other. ohio paycheck calculator | oh tax rates 2024. How income taxes are calculated. Effective federal income tax rate.. How Much Is Tax Per Dollar In Ohio.

From www.cleveland.com

Where Ohio ranks for taxes, and other trends identified in new study How Much Is Tax Per Dollar In Ohio For all filers, the lowest bracket applies to income up to $26,050 and the highest. Calculate your ohio state income taxes. the state has four tax rates: How income taxes are calculated. Marginal federal income tax rate. updated on jul 23 2024. Effective federal income tax rate. rates range from 0% to 3.75%. Estimate your tax liability. How Much Is Tax Per Dollar In Ohio.

From taxfoundation.org

State Tax Rates and Brackets, 2022 Tax Foundation How Much Is Tax Per Dollar In Ohio check our the us tax hub for ohio and discover how each ohio tax calculator provides the same high level of detailed calculations. Estimate your tax liability based on your income, location and other. ohio paycheck calculator | oh tax rates 2024. 0%, 2.75%, 3.68% and 3.75%. For all filers, the lowest bracket applies to income up to. How Much Is Tax Per Dollar In Ohio.

From taxwalls.blogspot.com

How Much Is Ohios Sales Tax Tax Walls How Much Is Tax Per Dollar In Ohio you are able to use our ohio state tax calculator to calculate your total tax costs in the tax year 2024/25. How income taxes are calculated. check our the us tax hub for ohio and discover how each ohio tax calculator provides the same high level of detailed calculations. your income taxes breakdown. updated on jul. How Much Is Tax Per Dollar In Ohio.

From www.templateroller.com

Amherst, Ohio Declaration of Estimated Taxes Fill Out, Sign Online How Much Is Tax Per Dollar In Ohio Estimate your tax liability based on your income, location and other. Effective federal income tax rate. Marginal federal income tax rate. check our the us tax hub for ohio and discover how each ohio tax calculator provides the same high level of detailed calculations. you are able to use our ohio state tax calculator to calculate your total. How Much Is Tax Per Dollar In Ohio.

From taxfoundation.org

Does Your State Have a Gross Receipts Tax? State Gross Receipts Taxes How Much Is Tax Per Dollar In Ohio you are able to use our ohio state tax calculator to calculate your total tax costs in the tax year 2024/25. rates range from 0% to 3.75%. 0%, 2.75%, 3.68% and 3.75%. updated on jul 23 2024. Effective federal income tax rate. ohio paycheck calculator | oh tax rates 2024. your income taxes breakdown. How. How Much Is Tax Per Dollar In Ohio.

From newriverkayakingmap.blogspot.com

Ohio Sales Tax Rate Map New River Kayaking Map How Much Is Tax Per Dollar In Ohio These rates are for income earned in 2023, which is reported on tax returns filed in 2024. your income taxes breakdown. For all filers, the lowest bracket applies to income up to $26,050 and the highest. the state has four tax rates: Marginal federal income tax rate. updated on jul 23 2024. 0%, 2.75%, 3.68% and 3.75%.. How Much Is Tax Per Dollar In Ohio.

From www.policymattersohio.org

Ohio’s tax breaks are ready for review How Much Is Tax Per Dollar In Ohio These rates are for income earned in 2023, which is reported on tax returns filed in 2024. your income taxes breakdown. Marginal federal income tax rate. the state has four tax rates: ohio paycheck calculator | oh tax rates 2024. Estimate your tax liability based on your income, location and other. you are able to use. How Much Is Tax Per Dollar In Ohio.

From exozsjyud.blob.core.windows.net

Highest Property Taxes In Ohio at Edward Cortez blog How Much Is Tax Per Dollar In Ohio updated on jul 23 2024. For all filers, the lowest bracket applies to income up to $26,050 and the highest. 0%, 2.75%, 3.68% and 3.75%. check our the us tax hub for ohio and discover how each ohio tax calculator provides the same high level of detailed calculations. Marginal federal income tax rate. How income taxes are calculated.. How Much Is Tax Per Dollar In Ohio.

From superagc.com

What Percentage Of Taxes Are Taken Out Of My Paycheck In Ohio Tax How Much Is Tax Per Dollar In Ohio Calculate your ohio state income taxes. check our the us tax hub for ohio and discover how each ohio tax calculator provides the same high level of detailed calculations. rates range from 0% to 3.75%. your income taxes breakdown. ohio paycheck calculator | oh tax rates 2024. How income taxes are calculated. Estimate your tax liability. How Much Is Tax Per Dollar In Ohio.

From www.policymattersohio.org

Ohio’s tax breaks are ready for review How Much Is Tax Per Dollar In Ohio These rates are for income earned in 2023, which is reported on tax returns filed in 2024. check our the us tax hub for ohio and discover how each ohio tax calculator provides the same high level of detailed calculations. Calculate your ohio state income taxes. updated on jul 23 2024. your income taxes breakdown. Effective federal. How Much Is Tax Per Dollar In Ohio.